What is Trailing Stop Loss and how to set Trailing Stop Loss?

Trailing stop loss is also called trailing stop loss. It is a stop loss method that sets a certain number of stop loss points by tracking the market price. As long as the floating profit generated by holding positions reaches the set value, trailing stop loss will be triggered to protect Profit from holding a position.

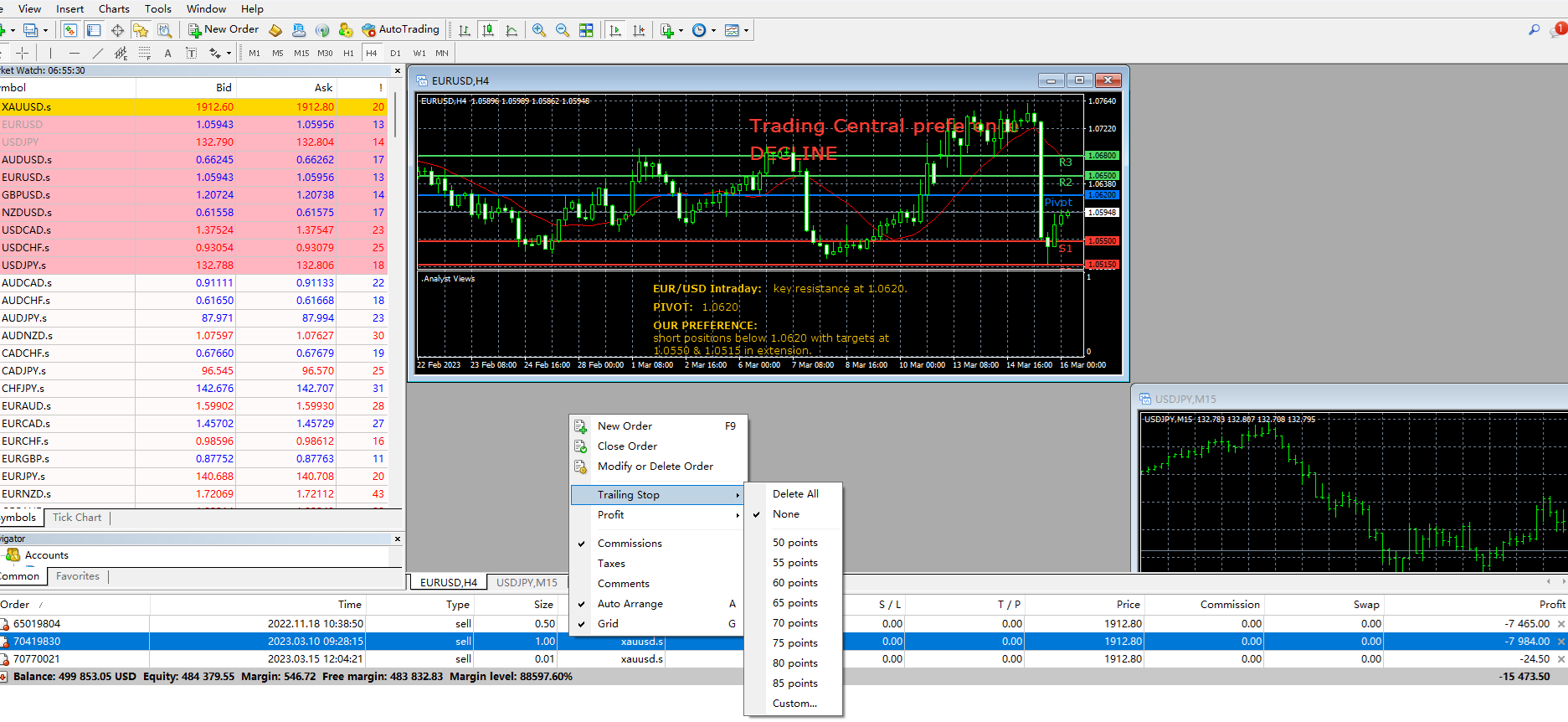

Take MT4 on the PC side as an example to set a moving stop loss:

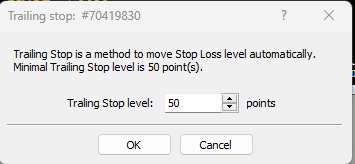

Please click "Trade" in the terminal bar to view existing orders, then right-click to select the holding order, click "Trailing Stop" and select "Custom", and fill in the number of trailing stop points you need to set.

For example, if the opening price of 1 lot is 1.00000 for a long EURUSD order, set a trailing stop loss of 100 points. When the price of the euro breaks through 1.00100, the trailing stop loss will be triggered. When the price of the euro falls back to 1.00100, the order will be stopped at 1.00100 implement.